nh food sales tax

3 older metal pump jacks used 2 saw horses 1 pair like new 2 ladder jacks 1. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

How To Charge Your Customers The Correct Sales Tax Rates

Consumer Protection Bureau Office of the Attorney General 33.

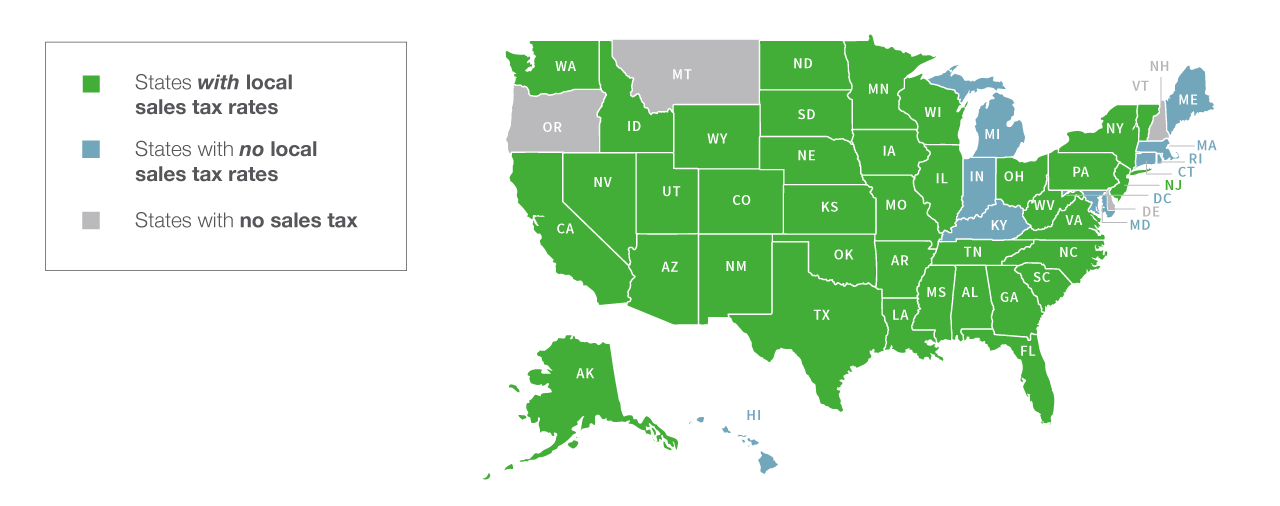

. Technical information release provides immediate information regarding tax laws focused physical areas of grocery stores convenient stores and gas stations. 1 hour agoUnder New York State law there is a 20 tax applied to the sale of e-cigarettes. While many other states allow counties and other localities to collect a local option sales tax New Hampshire does not permit local sales taxes to be collected.

While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxesin the country. Do NOT contact me with unsolicited services or offers Feb 22 2022 1 set of 2 pump jacks with brackets in good condition. Under this decision New Hampshire retailers are now subject to demands for customer information and tax payments from over 10000 separate taxing districts across the.

They send the money to the state. 2022 New Hampshire state sales tax. 1-888-468-4454 or 603 271-3641.

Be sure to visit our website at revenuenhgovGTC to create your account access today. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. 34 minutes agoMiniature donkeys for sale at Shorecrest Farms in Linden Pennsylvania.

While many other states allow counties and other localities to collect a local option sales tax New Hampshire does not permit local sales taxes to be collected. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. A bit of that money goes toward school building loans and tourism promotion.

If calling to inquire about the purchase of Tobacco Tax Stamps please contact the Collections Division at 603 230-5900. If you need any assistance please contact us at 1-800-870-0285. The tax is collected by hotels restaurants caterers and other businesses.

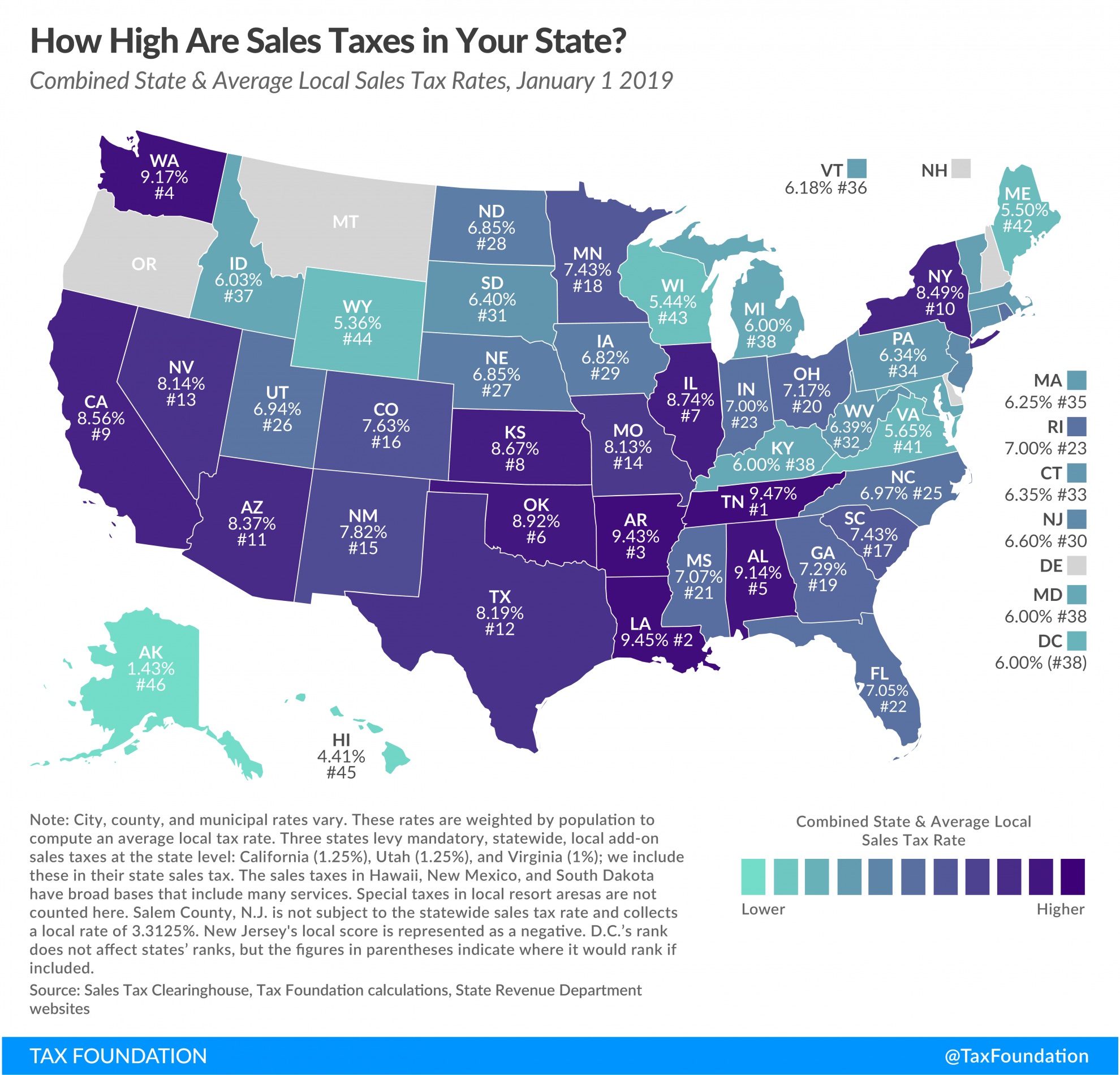

California 1 Utah 125 and Virginia 1. A 9 tax is also assessed on motor vehicle rentals. Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388.

New Hampshire Guidance on Food Taxability Released. Jack and motor both turn over. New Hampshire is one of the few states with no statewide sales tax.

Page 1 of 2 June 5 2019 Important Update on EpiPen epinephrine injection USP 0. Tax Returns Payments to be Filed. New Hampshire Property Tax.

Wayfair decision earlier this summer has stripped New Hampshire retailers of a key advantage in place for decades. Supreme Courts South Dakota v. It usually involves a large amount of research legworkon sale at Amazon for just.

Any New Hampshire business contacted by a state or locality regarding the collection of sales or use tax is also encouraged to contact the DOJs Consumer Protection Bureau. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. New Hampshire is one of the few states with no statewide sales tax.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at.

1 hour agoBipartisan legislation advanced last week would offer the team billion and a cut of sales tax revenue. NH Has No Sales Tax. The taxability of cold food sold to go in California depends in large part on the 80-80 rule.

The Portsmouth New Hampshire sales tax is NA the same as the New Hampshire state sales tax. Please visit GRANITE TAX CONNECT to create or access your existing account. LicenseSuite is the fastest and easiest way to get your New Hampshire foodbeverage tax.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered. 53 rows a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Exact tax amount may vary for different items.

Cow Pasture Mushrooms All Mushroom Info. There are however several specific taxes levied on particular services or products. 603 230-5945 Contact the Webmaster.

New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. Read more about the 8080 rule here. The Nashua New Hampshire sales tax is NA the same as the New Hampshire state sales tax.

Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. We include these in their state sales tax. B Three states levy mandatory statewide local add-on sales taxes.

Food prepared on the premises as defined in Rev 70116 which could reasonably be perceived as competing with an eating establishment. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022. The Nashua Sales Tax is collected by the merchant on all qualifying sales made within Nashua.

New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting.

A More than 80 of the sellers gross receipts are from the sale of. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. State State General Sales Tax Grocery Treatment.

If you need any assistance please contact us at 1-800-870-0285. Furthermore for every 100 pounds of their weight they can produce a larger rib-eye of about 1. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services.

If this rule applies to you and you do not separately track sales of cold food products sold for take-out 100 of your sales are taxable.

How Do State And Local Sales Taxes Work Tax Policy Center

New Hampshire Sales Tax Rate 2022

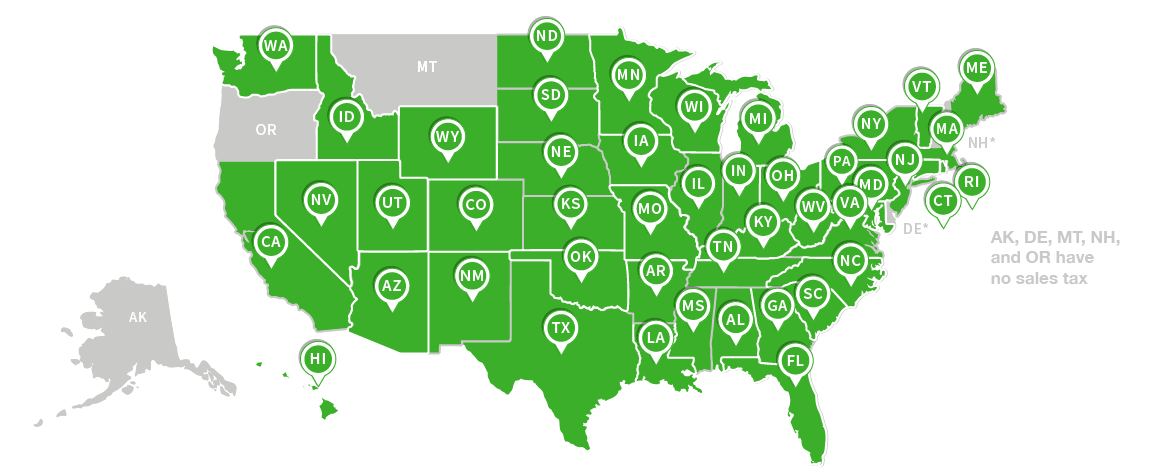

U S States With No Sales Tax Taxjar

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

New Hampshire Sales Tax Rate 2022

New Hampshire Sales Tax Handbook 2022

Kansas Sales Tax 8th Highest In The Nation The Sentinel

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

New Hampshire Sales Tax Rate 2022

Historical New Hampshire Tax Policy Information Ballotpedia

Sales Tax By State Is Saas Taxable Taxjar

Shipping Sales Tax In 2021 Taxability Examples Laws More

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

New Hampshire Meals And Rooms Tax Rate Cut Begins